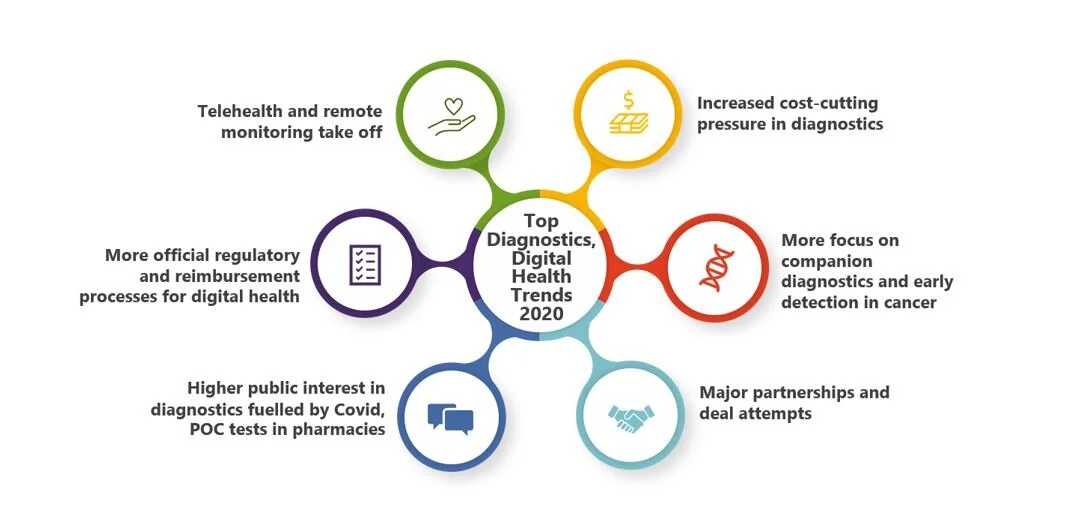

What were some top diagnostics and digital health trends last year? As we kickstart 2021, we look back at 2020 and reflect on these trends in this exceptional year.

1. Telehealth and remote monitoring take off

Telehealth took off in 2020 as the Covid pandemic increased the need for remote consultations.

Payers in countries such as the US, France and Australia have also responded by reimbursing teleconsults with dedicated tariffs. Notably, the US Centres for Medicare and Medicaid Services (CMS) plans to permanently expand telehealth services in 2021. France is also looking into more permanent reimbursement structures for remote monitoring.

Physicians worldwide have embraced the change by taking advantage of remote monitoring tools to assess a patient’s condition before deciding if an in-person consult is necessary. Meanwhile, large digital healthcare companies are also joining forces to provide more holistic offerings spanning the full patient journey. The $18b mega-merger between Teladoc and Livongo is a case in point where the latter provides patient monitoring between Teladoc health consults.

Manufacturers are also placing their bets on remote monitoring. Apple and JnJ launched a large scale RCT involving 150,000 seniors using Apple Watches and the Heartline app to detect and manage atrial fibrillation, a condition where patients suffer from an irregular heartbeat.

Much like working from home, healthcare is unlikely to completely revert to its old ways once the pandemic recedes. However, the wider adoption of telehealth has proven that the concept works in practice and generates efficiencies.

2. More regulatory, reimbursement frameworks in digital health to help healthcare professionals distinguish the wheat from the chaff

In 2020, Germany officially brought the DVG to life. The much-anticipated scheme allows digital healthcare firms to apply for reimbursement through a standard process where they must prove medical benefits and patient-relevant structural, procedural effects. As of 13 Jan, 4 health apps are eligible for permanent reimbursement, whilst another 6 have been admitted into the DiGA under temporary reimbursement. These apps cover different conditions ranging from multiple sclerosis to obesity to social phobias.

In the UK, NICE and NHS are also increasingly assessing digital healthcare solutions with standardised processes. After a successful pilot assessment with atrial fibrillation solution Zio Service, future digital assessments will focus on apps with the highest clinical, economic and/or operational risk to the healthcare system, also known as evidence tier 3 solutions, as classed by its Evidence Standards Framework for Digital Health Technology. Meanwhile, the NHSx is also revamping its application process for the NHS Apps Library where successful applicants can be certified fit-for-use in the NHS.

In the US, the FDA launched its Digital Health Centre of Excellence in 2020 to support regulatory advice on digital health products. It also piloted its Pre-Certification regulatory programme that focuses on evaluating the digital product and quality processes in digital health companies. True to the spirit of digital health, the FDA has taken an iterative approach to the pre-cert programme as it learns by doing.

In France, HAS is working on a risk-based classification of digital health apps, although it is unclear what full implications of this evaluation framework are. Notably, MoovCare, a lung cancer monitoring app, became the first digital app to reimbursed under the French List of Products and Healthcare Services Qualifying for Reimbursement (LPPR) at a €500 price tag.

3. Higher public interest in diagnostics fuelled by Covid, POC tests available in pharmacies

While Covid unleashed an infodemic, there have also been excellent examples of healthcare communication ranging from infographics of Covid tests to weekly podcasts on the topic (e.g. Christian Drosten’s Covid podcast in Germany). These set a new bar for healthcare communication.

Diagnostics feel less like a complex or distant topic, relevant only to those who are sick. Although Payers, prescribers and lab staff will remain key stakeholders for manufacturers in terms of reimbursement, it is up to diagnostic companies to ride this wave and endear themselves to the ultimate beneficiary of diagnostic testing - the patient.

With increased Covid testing needs, pharmacies have also stepped up to provide tests in countries like Switzerland, the UK and France. This builds momentum for discussions on bringing point-of-care testing into pharmacies, even in other chronic disease areas. Could pharmacies and non-traditional retail healthcare settings be the next customers for POC?

4. Increased cost-cutting pressure in diagnostics

Diagnostics represent a small fraction of healthcare costs but they are receiving increased Payer scrutiny. Switzerland has seen a tariff reduction for many nucleic acid amplification assays and multiple pathogen testing, as evidenced by Dec 2020’s tariff cut.

Whilst HTA has been a mainstay for pharmaceuticals, it is being increasingly applied in diagnostics. EUNetHTA has published 2 recent assessments on diagnostics, namely on lung cancer screening in risk groups and point-of-care troponin and D-dimer tests.

In the US, PAMA is in place. The law, passed in 2014, is aimed at reducing diagnostics costs by setting CMS prices based on what private Payers pay.

5. More focus on companion diagnostics and early detection in cancer

Companion diagnostics are enabling personalised treatments in oncology. To date, FDA has cleared more than 40 companion diagnostics for use.

Early detection has also come into focus. In a large scale trial announced Nov 2020, over 140,000 NHS patients aged 50-79 will be offered a blood test which detects their risk of over 50 types of cancer at an early stage. The test was developed by California-based Grail, which was acquired by sequencing company Illumina for $8b, as the latter goes upstream and boosts its capabilities in early detection.

6. Major partnerships, mergers and deal attempts

Illumina formed a 15-year cancer sequencing partnership with Roche which will grant Roche rights to develop and distribute tests on Illumina’s NextSeq™ 550Dx System.

Siemens Healthineers strengthened its position in the oncology field by acquiring radiation therapy leader Varian for $16.4b. Molecular diagnostics company Exact Sciences also acquired early cancer detection company Thrive for $2.5b, whilst Thermo-Fisher’s $11b bid for Qiagen fell through due to valuation disagreements after a surge in demand for the latter’s Covid tests.

For a deeper dive into these trends, contact us at info@centivis.com